Table Of Content

- Unlocking the Mystery: How Credit Cards Work

- 1. Card Issuance: The First Step in Your Credit Journey

- 2. Credit Limit: How Much You Can Borrow

- 3. Interest Rates (APR): The Cost of Borrowing

- The Transaction Process: From Swipe to Approval

- 4. Authorization: The Cardholder’s First Step

- 5. Processing: Behind-the-Scenes Transactions

- 6. Transaction Approval: The Final Go-Ahead

- 7. Credit Utilization: Impact on Your Credit Score

- Repayment: Managing Your Credit Card Balance

- 8. Billing Cycle: Understanding Your Statement

- 9. Minimum Payment vs. Full Payment: Your Payment Options

- 10. Interest Charges: The Cost of Carrying a Balance

- Credit Card Security: Safeguarding Your Transactions

- 11. Security Features: Protecting Against Fraud

- 12. Dispute Resolution: Handling Errors and Fraud

- Perks and Rewards: Getting More from Your Card

- 13. Credit Card Rewards: Making the Most of Your Spending

- Conclusion: Mastering Credit Card Usage

Unlocking the Mystery: How Credit Cards Work #

Credit cards are a cornerstone of modern finance, offering convenience, flexibility, and access to credit. But how do they work behind the scenes? While using a credit card may seem like a simple task, understanding the process and mechanics can help you make smarter financial decisions. This guide breaks down the key components of how credit cards function, from the application process to repayment and security features, so you can navigate the world of credit with confidence.

1. Card Issuance: The First Step in Your Credit Journey #

Credit cards are issued by financial institutions, most commonly banks or credit unions after you complete an application. The approval process typically involves evaluating your creditworthiness, which includes factors like your credit score, income, and outstanding debt. Once approved, you receive your card with specific terms and conditions.

2. Credit Limit: How Much You Can Borrow #

Every credit card comes with a credit limit, which is the maximum amount of credit you can use. This limit is determined based on your financial profile and the policies of the issuing institution. The higher your credit score and income, the higher your credit limit is likely to be.

3. Interest Rates (APR): The Cost of Borrowing #

Credit cards often come with an Annual Percentage Rate (APR), which determines how much interest you’ll pay on any outstanding balance. Understanding your card’s APR is essential, as it directly impacts how much you’ll owe if you carry a balance from month to month.

The Transaction Process: From Swipe to Approval #

4. Authorization: The Cardholder’s First Step #

When you make a purchase, the merchant sends a request to your card issuer for authorization. The issuer confirms that your card is valid, has not been reported as lost or stolen, and that you have sufficient credit available.

5. Processing: Behind-the-Scenes Transactions #

Once authorized, your transaction is processed through a secure payment network (Visa, MasterCard, etc.), which acts as an intermediary between the merchant, the card issuer, and the card network to ensure the transaction is completed smoothly.

6. Transaction Approval: The Final Go-Ahead #

Your card issuer evaluates your available credit, and account status, and performs fraud checks before approving or denying the transaction. If approved, the merchant proceeds with the sale, and the transaction is added to your account balance.

7. Credit Utilization: Impact on Your Credit Score #

The amount you spend on your credit card impacts your credit utilization ratio—the percentage of your available credit you’re using. Maintaining a low utilization ratio is key to maintaining a healthy credit score.

Repayment: Managing Your Credit Card Balance #

8. Billing Cycle: Understanding Your Statement #

Credit card transactions are grouped into billing cycles, usually lasting a month. At the end of each cycle, you’ll receive a statement showing all your transactions, your outstanding balance, and the minimum payment due.

9. Minimum Payment vs. Full Payment: Your Payment Options #

You have two main repayment options:

- Minimum Payment: This is the smallest amount you can pay to avoid late fees and stay current on your account. However, interest will accrue on the remaining balance.

- Full Payment: Paying your full balance by the due date ensures you avoid interest charges, as many cards offer a grace period for purchases if you pay in full.

10. Interest Charges: The Cost of Carrying a Balance #

If you don’t pay off your balance in full, interest will be charged on the remaining amount. The APR will determine the rate at which interest is added to your balance, so it’s important to understand this rate to avoid high fees.

Credit Card Security: Safeguarding Your Transactions #

11. Security Features: Protecting Against Fraud #

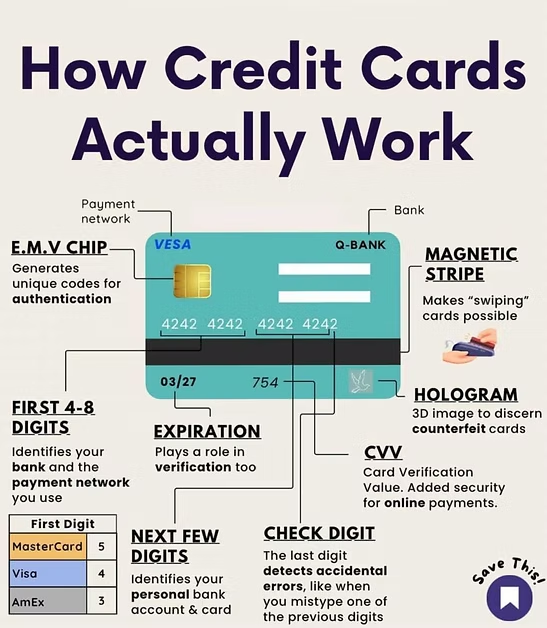

Credit cards come with several security features, including EMV chips, magnetic stripes, and holograms. These measures help protect against fraud and unauthorized use. In addition, most issuers provide fraud detection systems to alert you of suspicious activity.

12. Dispute Resolution: Handling Errors and Fraud #

If you notice any fraudulent charges or mistakes on your statement, most credit card companies allow you to dispute the transaction. They will investigate the issue, and if necessary, reverse the charge through a chargeback.

Perks and Rewards: Getting More from Your Card #

13. Credit Card Rewards: Making the Most of Your Spending #

Many credit cards offer rewards programs, giving you cash back, points, or miles for every dollar spent. By understanding how these programs work, you can maximize the rewards you earn and use them for travel, merchandise, or statement credits.

Conclusion: Mastering Credit Card Usage #

Credit cards offer flexibility and convenience, but using them wisely is essential for maintaining a healthy financial profile. By understanding how credit cards work—from the issuance process to transaction approval and repayment strategies—you can manage your finances effectively, avoid debt, and even leverage rewards to your benefit. Keep these insights in mind, and the next time you pull out your credit card, you’ll understand the intricate systems at play behind every swipe.

Pro Tip: Always aim to pay off your balance in full each month to avoid interest charges and keep your credit score in good shape.

posting, Understanding Credit Cards, How Credit Cards Work

Typical Rates in GrandLimousine

| Vehicle Type | Hourly Rate | Min. Hours |

|---|---|---|

| Sedan (4-pass) | $85+ | 3 Hours Minimum |

| SUV (6-pass) | $120+ | 3 Hours Minimum |

| Stretch Limo (6-10 pass) | $160+ | 3 Hours Minimum |

| Hummer Limo (18-pass) | $270+ | 4 Hours Minimum |

*Prices may vary based on demand and special events in GrandLimousine.